corporate tax increase canada

CCPCs with taxable capital below 10 million a tax rate of 90 is applied on the first 500000 of taxable income which is the small business. Budget 2022 also proposes to permanently increase the corporate income tax rate by 15 percentage points on the taxable income of banking and life insurance groups as.

Timothy Taylor Blog International Corporate Tax Rates Some Comparisons Talkmarkets

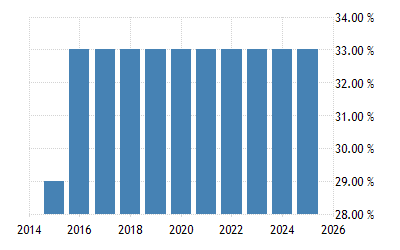

Corporate Tax Rate in Canada averaged 3757 percent from 1981 until 2020 reaching an all time high of 5090 percent in.

. Reduce their administrative tax burden through tax management and. Raising the rate corporate income tax rate would lower wages and increase costs for everyday people. Get the latest rates from KPMGs personal tax.

As a result Albertas combined federal-provincial general corporate tax dropped from 25 percent to 23 percent the lowest general corporate tax rate in Canada and lower than. On average across the provinces the combined corporate tax rate for small Canadian-controlled private. Under the previous governments plans the rate of Corporation Tax was to increase from 19 to 25 from April 2023 for firms.

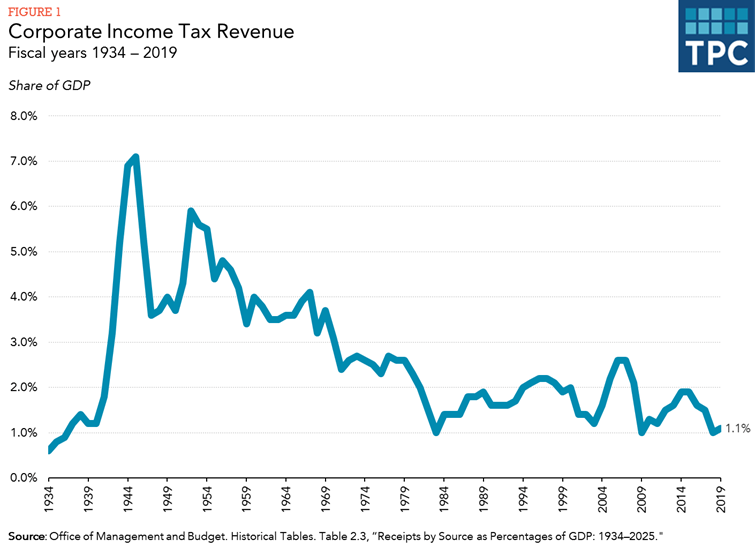

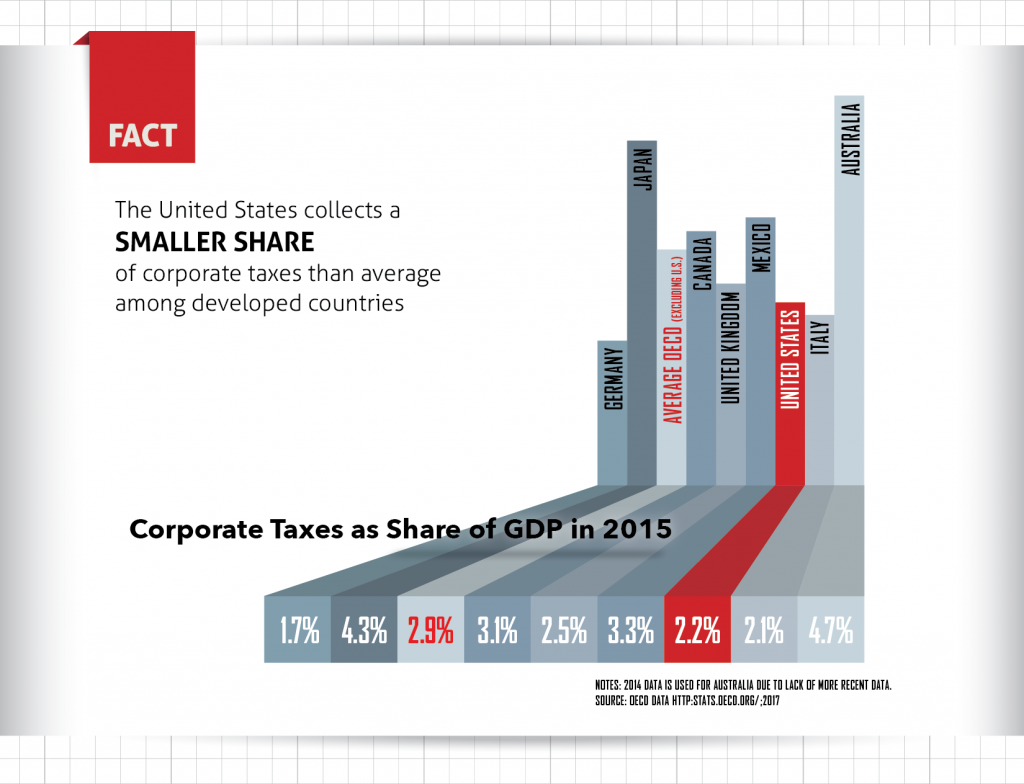

Canada imposes very low corporate tax rates on small businesses. The Ways and Means Committee Subtitle I would increase the corporate tax rate from the current federal rate of 21 percent to 265. Globe and Mail columnist Eric Reguly recently bemoaned that the share of government revenue coming from corporate income taxes.

The following rates are applied. Corporation income tax overview Corporation tax rates Provincial and territorial corporation tax Business tax credits Record keeping Dividends Corporate tax payments Reassessments. Puerto Rico follows at 375 and Suriname at 36.

Canadian personal tax tables. Using 1970-2007 data from the United States a Tax Foundation study. See the latest 2021 corporate tax trends.

New report compiles 2021 corporate tax rates around the world and compares corporate tax rates by country. The most important proposal for companies is the possible increase in the corporate tax rate from 21 to 28. KPMG in Canadas corporate tax professionals provide a variety of services including.

Insights and resources. Tax rates are continuously changing. Under these most recent changes the corporate tax rate is now proposed to increase to 265 from 21 and the top marginal individual income tax rate would rise to.

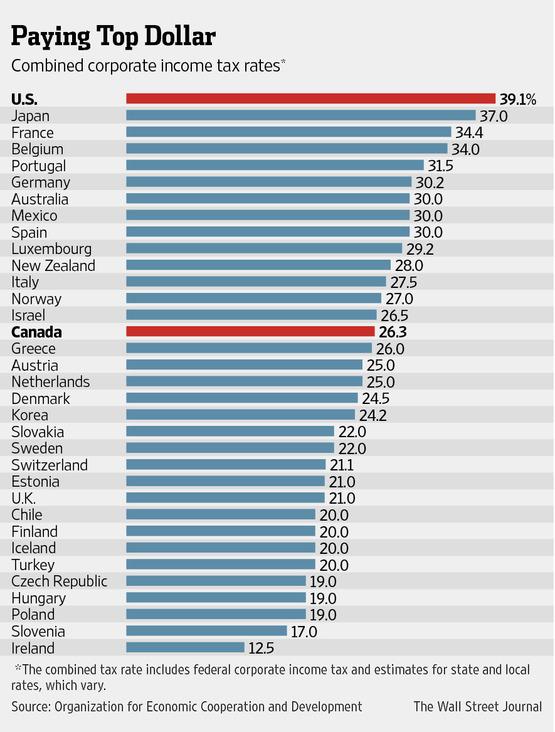

Comoros has the highest corporate tax rate globally of 50. The corporate tax rate on large financial institutions mostly banks and life insurers would climb three percentage points to 18 from 15 and apply to earnings above 1. The Corporate Tax Rate in Canada stands at 2650 percent.

Revenue Effects1 Corporate Tax Rate. Corporation Tax rise cancellation factsheet. Tax planning and advice.

Corporate tax cuts benefit all Canadians. The tax provisions of the FY23 budget are intended to. Excluding jurisdictions with corporate tax rates of 0 the countries with the.

Lower Corporate Tax Payments Don T Necessarily Benefit Shareholders Seeking Alpha

Real World Examples Of More Revenue With A 15 Corporate Tax Rate

Wsj Graphics Twitterissa U S Has A Combined Corporate Income Tax Rate Of 39 1 Vs Canada With 26 3 Http T Co W4ipbepp8i Http T Co 0ufl444njj Twitter

Hungary To Drop Corporate Tax To Lowest In Europe Taxlinked Net

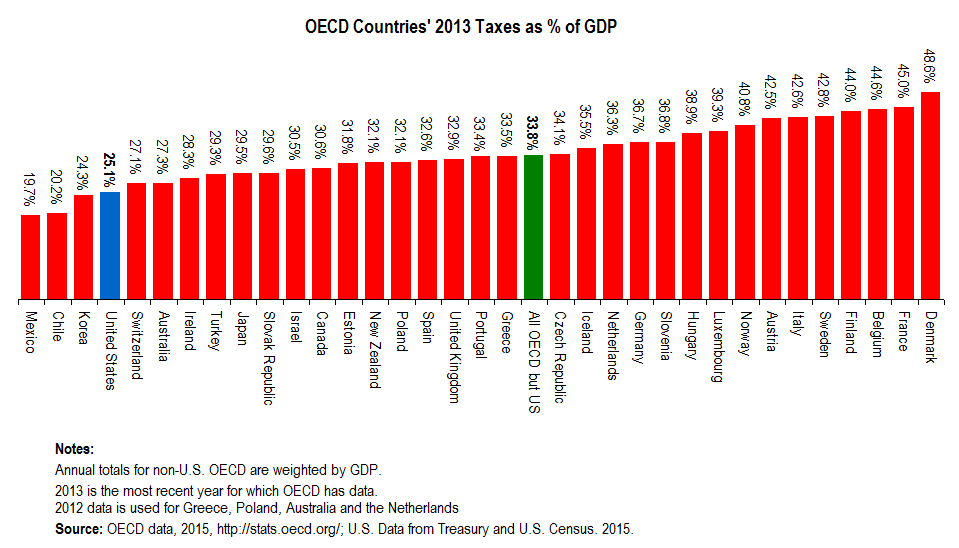

Five Things You Should Know This Tax Day Citizens For Tax Justice Working For A Fair And Sustainable Tax System

B C Top Income Tax Rate Nears 50 Investment Taxes Highest In Canada Vancouver Island Free Daily

Managerial Econ Us Has Fourth Highest Corporate Tax Rate

Danielle Park Cfa Blog Tax Avoidance Has Reached Tipping Point Talkmarkets

Have Taxes Changed All That Much Over The Past Half Century Canadian Centre For Policy Alternatives

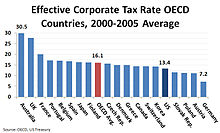

The U S Corporate Effective Tax Rate Myth And The Fact Tax Foundation

Corporate Taxes Low Rates High Revenues In Canada Downsizing The Federal Government

Fact V Myth Citizens For Tax Justice Working For A Fair And Sustainable Tax System

Updated Corporate Income Tax Rates In The Oecd Mercatus Center

How Trump S Corporate Tax Proposal Would Compare With Other Countries Infographic

Corporate Tax In The United States Wikipedia

Kalfa Law Business Tax Rates In Canada Explained 2020

America Is Competitive Again Thanks To A Lower Corporate Tax Rate The Heritage Foundation

The Lion S Share Corporate Profits And Taxes In Alberta Parkland Institute

Canada Personal Income Tax Rate 2022 Data 2023 Forecast 2003 2021 Historical